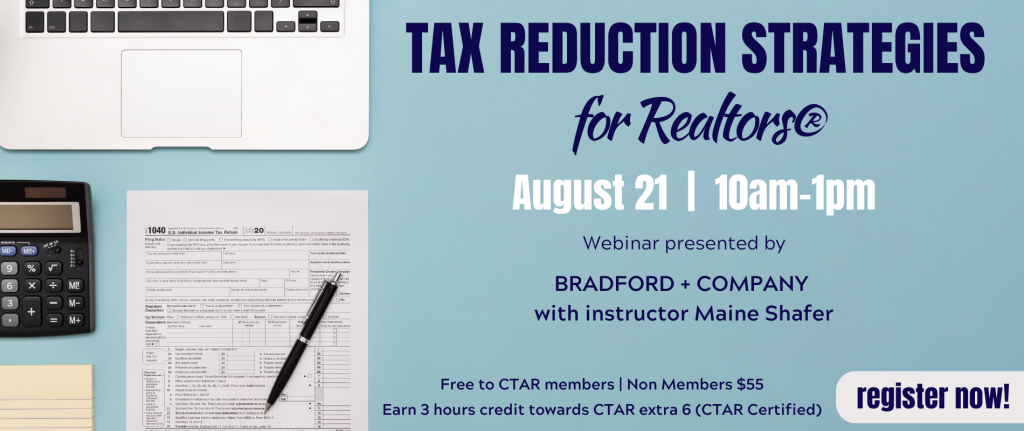

Unlock your Personalized Tax Strategies to Drastically Reduce your Tax Bill – Tax Reduction Strategies for the Real Estate Professional

(Virtual Webinar) | August 21 | 10:00am – 1:00pm | Presented by: Bradford and Company | National Instructor: Maine Shafer

Earn 3 hours credit towards CTAR extra 6 (CTAR Certified) | (Not approved for LLR CE credit)

Keep More of Your Hard-Earned Money in 2025 and Beyond!

After this seminar, you’ll have what you need to bring to your tax accountant, so you can keep more of your income this year and beyond!

Here’s some of what you’ll learn:

• HOW to POWER BOOST your deductions: Best business practices to optimize tax benefits and understand your elite status as a taxpayer.

- UNDERSTAND your tax professional’s role and how to partner with them effectively to reduce your tax liability.

- HOW TO deduct all of your FAMILY’S MEDICAL COSTS-even dental-as a real estate BUSINESS expense!

- HOW to deduct your Home Office…simplified, made safe, and expanded to multiple deductions! Learn the rules to INCREASE this deduction!

- WHY you may want to buy a new or pre-owned car sooner than you think…the great new “makeover” of the CAR DEDUCTION rules you will want to take advantage of!

- Food and beverage deductions for real estate professionals that you probably don’t know about.